Income Tax Department- Faceless!

Keeping with Digital India drive, revenue authorities have been on the forefront to enable digital interface between the taxpayers and the officials. First such beginning was in 2006 with launching of the project for electronic filing of tax returns where initially, e-filing of tax returns was made mandatory with effect from AY 2006-07 in tax audit cases, with its phased implementation over a period of time, to cover almost all the assesses now, barring few exceptions. To facilitate this, e-filing portal (www.incometaxindiaefiling.gov.in) was launched as a digital interface between the taxpayers and the officials. This was followed by setting-up of CPC, Bangalore in 2009 for the purposes of electronic processing of returns filed electronically.

Taking the baton of digital drive further, electronic assessment proceedings were introduced on pilot basis in 2015 at New Delhi and Mumbai, with its expansion to other cities in 2017. Formal system of electronic assessment was introduced by Finance Act 2018 with insertion of sub-sections (3A), (3B) and (3C) to section 143 of the Income Tax Act, 1961 (‘Act’). Subsequently, E-Assessment scheme, 2019 was notified vide Notifications No. 61 & 62 of 2019 dated 12 September 2019. Under such scheme, approx. 58,322 cases were selected for scrutiny assessment for AY 2018-19.

Finance Act,2020 also amended section 143(3A) of the Act to include even ‘best judgment assessment’ as prescribed under section 144 of the Act within the ambit of electronic assessment.

With COVID-19 outbreak, physical interaction between the taxpayers and the revenue officials came to a standstill interalia due to imposition of lockdown. Various deadlines prescribed under provisions of the Act were extended, first by ‘The Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020’ dated 31 March 2020 (‘Ordinance’) and then later by CBDT notification number 35/2020 dated 24 June 2020. Consequently, statutory timeline for completion of assessments during FY 2020-21 i.e. for AY 2018-19 & AY 2017-18 (for Transfer Pricing and belated return cases) stand extended to 31 March 2021.

Armed with achievement of twin objectives, vis-a-vis: expansion of the scheme of electronic assessments to a larger strata of cases, which was otherwise planned in near future and to combat COVID-19 scenario with its application to the pending assessments as well, Hon’ble Prime Minister launched ‘Faceless Assessment Scheme’ under the campaign ‘Transparent Taxation: Honouring the Honest’ on 13 August 2020. Apart from Faceless Assessments (effective from 13 August 2020), the campaign also introduced Faceless Appeal (effective from 25 September 2020) and Taxpayer’s Charter (effective from 13 August 2020) containing revenue authorities’ commitments towards taxpayer and duties of/expectations from Taxpayers. Pursuant to introduction of the Scheme by Hon’ble PM, all the assessment orders to be passed after 13 August 2020 must need to be issued under Faceless Assessment Scheme and any order passed outside the scheme (except for the exclusions mentioned hereunder) will be considered as ‘non-est’ i.e. never in existence.

The scheme is now on its path to be brought formally into the statute books by way of introduction of section 144B of the Act w.e.f. 01 April 2021, as proposed by Taxation and Other Laws (Relaxation and Amendment of certain provisions) Bill, 2020 introduced in Lok Sabha on 18 September 2020 (‘Amendment Bill’) and passed on 19 September 2020.

Apart from the Faceless Assessment, the Amendment Bill is now on its way to make all the income tax department proceedings almost ‘faceless’ for the taxpayers by introducing Faceless Transfer Pricing Proceedings, Faceless rectification, Faceless verification, Faceless revisionary order, Faceless appeal effect orders, Faceless collection/recovery of taxes, Faceless transfer of jurisdiction, Faceless compounding of offences etc.

Faceless Assessment Scheme1

The scheme has been launched with amendment to the erstwhile Notifications number 61 & 62 of 2019 dated 12 September 2019 (issued under electronic assessment scheme 2019) vide Notifications number 60 & 61 of 2020 dated 13 August 2020. The scheme as introduced and further proposed to be amended by the Amendment Bill is summarised as under:

Key Features

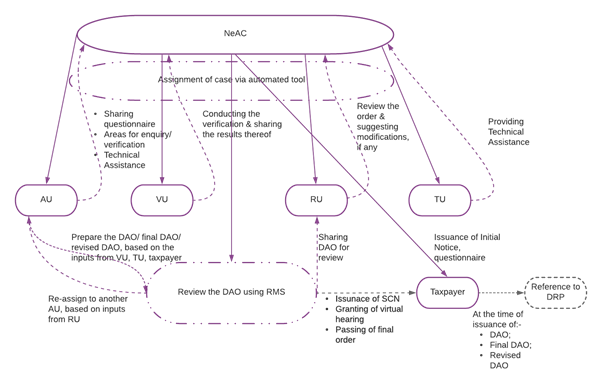

- Assessment will be a unit-based assessment supervised/governed under the aegis of National E-Assessment Centre (‘NeAC’)2 and conducted by Assessment Unit (‘AU’) with appropriate assistance from Technical Unit (‘TU’), Verification Unit (‘VU’) and Review Unit (‘AU’);

- Each unit will have its independent functioning, headed by Chief Commissioner of Income Tax (‘CCIT’), however, TU has been structured to report directly to Principal Chief Commissioner of Income Tax (‘Pr CCIT’), NeAC);

- There will be no interaction between the taxpayers and the four units. The National E-Assessment Centre (‘NeAC’) will be the mediator between the tax payer and the units. Every communication will pass through NeAC and that too electronically;

- NeAC may send notices via email, SMS or the registered account of the taxpayers’ e-filing portal (www.incometaxindiaefiling.gov.in). Only mode of communication available to the taxpayers is filing of responses to the notices issued by NeAC via e-filing portal (www.incometaxindiaefiling.gov.in);

- Similarly, all four units cannot communicate amongst themselves. Any communication amongst them would be via NeAC;

- All communications by NeAC would carry a Document Identification Number (‘DIN’);

- Similarly, all responses filed by taxpayers must be electronically signed either by way of Digital Signatures or by way of Electronic Verification Code (‘EVC’).

Coverage

- Assessment under the Scheme will commence subsequent to selection of the cases for assessment electronically. It is yet to be seen as to whether such selection would continue to be by existing Computer Aided Selection Scrutiny (‘CASS’) criteria or there would be use of artificial intelligence/machine learning in selection of cases as well;

- Assessments to be covered by the scheme are assessments initiated:

- Pursuant to issuance of a notice under section 143(2) of the Act, viz:

- Scrutiny assessments under section 143(3) of the Act;

- Best Judgment Assessments under section 144 of the Act;

- Scrutiny Assessments under section 143(3) of the Act subsequent to filing of return of income in response to a notice issued under section 148 of the Act for income escaping assessment;

- By way of an intimation by NeAC, where, no tax return has been furnished by the taxpayer in response to the notices issued section 142(1) and 148 of the Act.

- Pursuant to issuance of a notice under section 143(2) of the Act, viz:

Exclusion3

Faceless Assessment Scheme is not applicable to the following cases of assessment:

- Assessments in cases assigned to Central Charges, mostly in search and seizure cases; and

- Assessments in cases assigned to International Tax Charges.

Procedure

- Upon selection of the case for assessment, NeAC will assign the case to an AU selected via an automated allocation system, which may employ artificial intelligence or machine learning;

- Upon receipt of the case for assessment, AU will intimate the details which it may require from the taxpayers;

- Once the details required are communicated by AU, NeAC will issue the notice to the taxpayers;

- Taxpayers need to respond within the time specified in the notice (generally 15 days) or such extended time as it may request. Failure to respond to such notice may result in initiation of penalty proceedings under section 272A of the Act and after few reminders as well if there is non compliance, the same would result in best judgment assessment in terms of section 144 of the Act;

- In case AU opines that an enquiry or verification needs to be conducted, it will intimate NeAC who in turn will intimate the same to a VU again selected through an automated allocation system.

- VU will conduct the verification and submit its report to NeAC for onward forwarding to the AU from which request for verification was received;

- Similarly, AU may seek technical assistance from TU via NeAC at any point of time of the proceeding;

- Upon receipt of the information/reports, AU will prepare the draft assessment order (‘DAO’) based on the information available on records and forward the same to NeAC;

- NeAC will examine the DAO keeping in mind its risk management strategy (using AI) to either finalise the DAO or grant opportunity to taxpayer or to send it to RU for review;

- NeAC will finalise the assessment order based on DAO, in case no modification has been proposed as compared to the returned income;

- Where any modification has been proposed, NeAC will grant an opportunity to the taxpayer by issuing a show cause notice (‘SCN’). In response to the SCN, the taxpayer may file its written submissions as well as seek an opportunity for ‘hearing’ to present its case. Upon receipt of the request of hearing, NeAC will forward such request for hearing to CCIT of the ReAC under which AU has framed the DAO. CCIT may grant the request for hearing in accordance with guidelines to be laid down by NeAC. Hearing granted, if any, shall be conducted virtually;

- As mentioned above, NeAC may share DAO to RU for the purposes of review of the DAO, inter-alia for inclusion of various points of facts and law/judicial precedents etc.;

- Where RU has made some suggestions for the purposes of modifications to the DAO, NeAC will re-assign the case to any AU, other than the one which has framed DAO, through automated allocation system;

- The new AU, pursuant to considering the suggestions/variations proposed by RU, may prepare the final DAO and forward it to NeAC;

- NeAC may again either finalise the assessment based on final DAO or issue SCN to the taxpayer where a variation prejudicial to it has been proposed;

- Where any response has been furnished by the taxpayer against the final DAO, the new AU may prepare revised DAO based on the responses received from the taxpayer;

- NeAC will follow the above procedure of issuance of SCN etc. again to the taxpayer, in all probability, till no further modification is to be proposed or the taxpayer has no further explanations, as the case may be, subject to the availability of time for completion of assessment;

- Section 144B of the Act (as proposed by the Amendment Bill) provides an option to the taxpayer to file its objections under section 144C of the Act before Dispute Resolution Panel (‘DRP’) either against a:

- DAO (i.e. the first draft order prepared by AU based on material available on record); or

- Final DAO (i.e. pursuant to considering the suggestions of RU); or

- Revised DAO (i.e. upon considering the responses filed by the taxpayers against the final DAO);

- Upon finalisation of the order, NeAC will serve the final order alongwith notice for initiation of penalty and notice of demand;

- Upon completion of the assessment, all the electronic records will be transferred to the jurisdictional officer.

NeAC may transfer the case to the jurisdictional officer for completion of assessment, at any stage of the proceedings, with prior approval of CBDT.

The Scheme is also explained by way of below pictorial presentation:

Proceedings to be taken up by the Jurisdictional Hierarchy

- It is believed that upon transfer of the records from NeAC to the jurisdictional officer, the jurisdictional officer shall initiate the proceedings for imposition of any consequential penalties arising out of the assessment proceedings, say penalty for misreporting or under-reporting of income under section 270A of the Act. The CBDT would soon come with guidelines with respect to the penalty proceedings as well;

- Other residuary functions, such as rectification, stay of demand, special audit, other judicial functions etc. would also be carried out by the jurisdictional officers.

Other Amendments Proposed by the Bill

The Amendment bill has also proposed to move necessary amendments to enable the Central Government for formulation of a Scheme subsequently, to effect the following in a ‘Faceless’ manner, to be effective from 01 November 2020:

- Reference to Transfer Pricing Officer for Faceless Proceedings – Section 92CA(7) of the Act;

- Faceless Jurisdiction of the tax officers- Section 130 of the Act;

- Faceless Collection of Information-Section 135A of the Act;

- Faceless Inquiry or issuance of 142(1) notice or valuation- Section 142B of the Act;

- Faceless Issuance of Directions by DRP- Section 144C(14B) of the Act;

- Faceless Assessment of Income Escaping Assessment under section 147/148 of the Act- Section 151A of the Act;

- Faceless Rectifications- Section 157A of the Act;

- Faceless issuance of lower withholding certificates, income tax clearance certificates to the expatriates, stay of demand and/or collection or recovery of taxes- Section 231 of the Act;

- Faceless Appeal before Income Tax Appellate Tribunal- Section 253(8) of the Act;

- Faceless Revision of Order under section 263 or 264 of the Act- Section 264A of the Act;

- Faceless effect of the appeal orders pursuant to CIT(A)/ITAT/HC/SC Order or orders giving effect to revisionary order under section 263 or 264 of the Act- Section 264B of the Act;

- Faceless Compounding of offences against the proposal for initiation of prosecution- Section 279(4) of the Act;

- Faceless approval or registration under any provision of the Act- Section 293D of the Act.

Faceless Appeals

Just like Faceless Assessment, Faceless Appeals have also been introduced by way of introduction of sub-sections (6B), (6C) and (6D) to section 250 of the Act by Finance Act, 2020. Further, Hon’ble Prime Minister also announced introduction of ‘Faceless Appeals’ under the ‘Transparent Taxation Platform’, which will be effective from 25 September 2020. Presently, Hon’ble Supreme Court of India, Hon’ble High Courts and Hon’ble Income Tax Appellate Tribunal are also conducting virtual hearings in respect of urgent pending matters. With launching of transparent platform, the entire chain of events- right from the filing of tax return to the ultimate appeal resolution mechanism by Hon’ble Supreme Court is to go ‘Digital’ thereby realising Hon’ble Prime Minister’s dream of Digital India, at least in Direct Taxes.

Closing Remarks

In order to make Faceless Assessment Scheme as well as other proposed Faceless interactions with the tax officers a success, both the revenue officials as well as the taxpayers need to adapt themselves with the new era of virtual proceedings.

With team-based approach to assessment, one can expect qualitative queries and well thought through orders with a legal backing.

While this is a very bold and welcome step, the key/success will lie in the manner in which it gets implemented. It is learned that so far as the Faceless Assessments are concerned, in order to ensure quality in the processes, it may be further proposed that each of the four units shall provide their feedback in the automated system devised/to be devised by the revenue officials, i.e. AU at the time of submitting DAO and VU/TU/RU at the time of submitting their reports.

Some of the pre-cursers for the Taxpayers under the ‘Faceless Era’ would be to ensure:

- Updated contact details on the e-filing portal (www.incometaxindiaefiling.gov.in);

- Adherence to time lines specified;

- Well trained team to support timely compliance with the notices to avoid penalties and best judgement assessments’

- Clear and detailed submissions on each and every point and clear articulation of facts as no physical hearings to explain the issues;

- Maintenance of proper and exhaustive documentation for each and every submission made for future reference if any;

- Maintain documentary evidence explaining the reasons as to why these could not be furnished at the time of assessment.

For the purposes of bringing transparency in the virtual platform, Prime Minister also unveiled Taxpayer’s Charter which need to be adopted both by the revenue officials as well as the taxpayers. Keeping the momentum positive, let us hope that this will transform India as a destination for ‘doing business easily’ thereby making it ‘Atma Nirbhar’.

1. Changes as proposed to be introduced by the Amendment Bill in the Faceless Assessment Scheme are being highlighted in italics

2. The Amendment bill proposes to use the term ‘National Faceless Assessment Centre’ (NFAC)

3. Presently, the amendment bill doesn’t provide for the above exclusions, it is yet to be seen whether the above exclusions introduced by CBDT vide order dated 13 August 2020, would be withdrawn and international tax/search cases would also be governed by the Faceless Assessment Scheme

The above article is authored by Anita Basrur, Partner at Sudit K Parekh & Co. LLP. The views expressed our personal.

Recent Insights

- SEBI Mandates Reporting of AIF NAV to Depositories

- RBI Notifies Amendments to the External Commercial Borrowing (ECB) Framework

- SA 260 Revisited: Strengthening Communication Between Auditors and Those Charged with Governance

- Segment Reporting as a Focus Area for Regulators

- Ethical Considerations in Using External Experts in Assurance and Related Services Engagement

SUBSCRIBE TO OUR INSIGHTS

We are constantly working on sharing relevant alerts & publications to keep you informed on the latest developments.